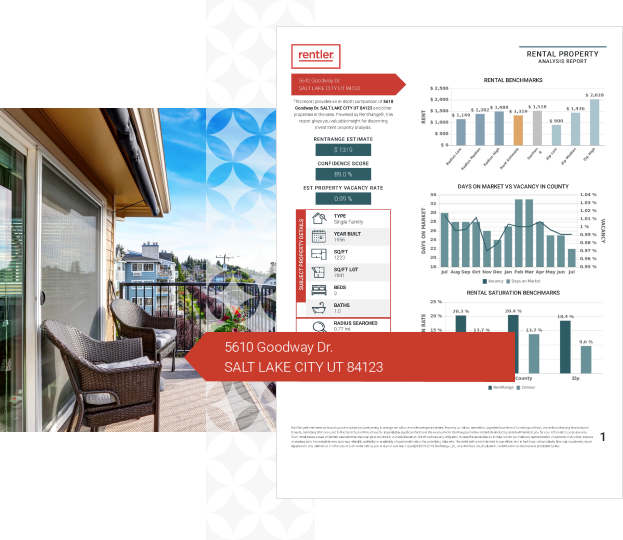

Set the right rent price with a Rentability® Report

Get a customized report with comparable properties, local trends, and a recommended rental price for your property. Only $19.95 per report.

Get your reportFill vacancies and maximize revenue

Competitive rent prices help you attract tenants faster. When you understand local market rental rates, you can make sure you aren’t pricing too high or too low.

Better understand your market

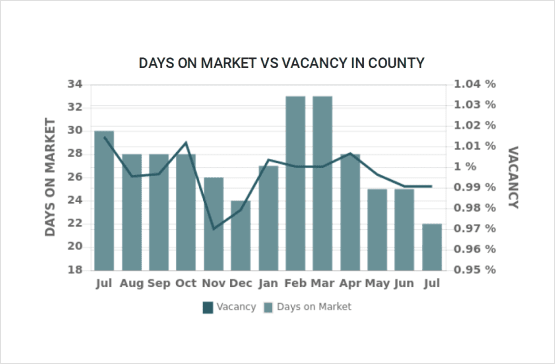

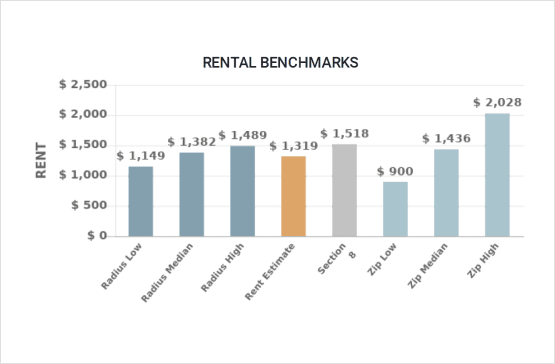

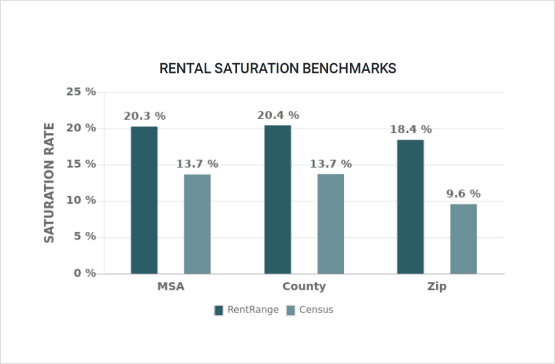

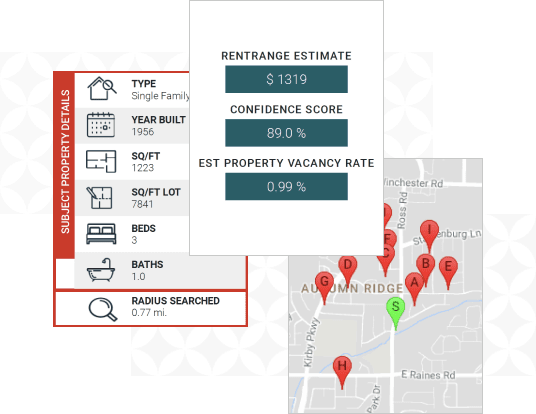

Since our reports are based on your specific property, you’ll get insights into similar listings, market saturation, vacancy rates, and trends for your area.

Gain an edge with real-time reporting

We instantly pull internal and national data to make sure you have the most up-to-date market analysis available.

Frequently Asked Questions

What are Rentability® Reports?

A Rentability Report is a full analysis of how much your rental is worth based on a comparison of similar properties. We pull data from our internal database, as well as national records, so you have a complete picture of your ideal rental price.

The report includes an overview of similar listings, market saturation, vacancy rates, and trends for your area. It also gives you a recommended rent price and an estimated vacancy rate which can help you decide when it’s necessary to adjust your price. To see a sample report, click here

The report includes an overview of similar listings, market saturation, vacancy rates, and trends for your area. It also gives you a recommended rent price and an estimated vacancy rate which can help you decide when it’s necessary to adjust your price. To see a sample report, click here

How do you pull data for a Rentability® Report?

Rentler is partnered with RentRange, one of the largest and most accurate rental datasets, to give you the most accurate picture of the rental industry. Data is pulled from both national MLS coverage and extensive proprietary data that includes historical data back to January 2009.

Why do I need a Rentability® Report?

Setting a competitive rent price can ensure that you fill vacancies quickly, but it also helps you determine your rental yield. Rental yield is the amount of money you make on your investment after factoring in mortgage, bills, and repairs, and depending on your area 5-10% is standard.

Once you’re confident that your rent price is going to be a net positive cash flow for your rental investment, you can determine if you have room to lower the price if your vacancy rate is longer than average or raise the price if your area’s economic climate requires it.

Once you’re confident that your rent price is going to be a net positive cash flow for your rental investment, you can determine if you have room to lower the price if your vacancy rate is longer than average or raise the price if your area’s economic climate requires it.

What kind of rentals are Rentability® Reports for?

Rentability Reports can be conducted for all rental types; single-family homes, condos, apartments, townhomes, and more. However, Rentability Reports will have the most data for single-family and multi-family homes. We can still compare your rental with similar properties from our database, but your results may be less accurate. If there are no properties for comparison (typically with studio apartments and subleases) you will be prompted to change your selection before proceeding.

Ready to set your rent prices?

Add a property to your Rentler account and request a custom Rentability® Report.

Get your report